hotel tax calculator florida

The room is priced at 115 pre-tax with a price of 50 per night. 79 rows The state and local tax rate on a poor unsuspecting non-voting tourist can reach 13 when the state 6 sales tax rate is combined with the local rate of up to 7.

Rentals of an entire home are taxed at 8.

. Hotel tax in Orange County you did post in the Orlando Forum is 65 sales 60 resort for a total of 125. Taking the example of a nights stay it costs 134 to stay at a hotel. This is calculated by using 300 7 2100.

Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Florida local counties cities and special taxation districts. Below is a chart of the 2015 state and local tax rates imposed on sleeping accommodations by county which inter-county exceptions provided at the end of the list. Hotel and room rentals are taxed at 13.

Tax Amount 1. Contact them at 239-348-7565 for details. Our calculator has been specially developed in order to provide the users of the calculator with not only how much tax they will be paying but a.

So if the room costs 169 before tax at a rate of 0055 your hotel tax will add 169 x 0055 9295 or an extra 930 per night. Florida Salary Calculator for 2022. Subtract the cost of the room before taxes from the cost of the room after taxes.

This is the tax per night. Individual Florida counties may impose a local option tax on transient rental accommodations such as the. You can now choose the number of locations within Florida that you would like to compare the Sales Tax for the product or service amount you entered.

In addition this Bed Tax the State of Florida levies a six 6 Sales Tax on this income. Additionally no Florida cities charge a local income tax. Every owner of a short-term accommodation is required to register with the Collier County Tax Collector.

Lodging amount to be allocated to non-reimbursable. I do not know where you got your information. After choosing the number os Locations to compare a list of.

It is 8156 of the total taxes 431 billion raised in Florida. The sales tax is calculated by multiplying the whole dollar amount by the tax rate 6 plus the county surtax rate and using the bracket system to figure the tax on the amount less than a dollar. The minimum combined 2022 sales tax rate for Tampa Florida is.

Some examples are hotel and motel rooms condominium uni ts timeshare resort units single-family homes apartments or units in multiple unit structures mobile homes beach or vacation houses campground sites and trailer or RV parks. Our calculator has recently been updated to include both the latest Federal Tax Rates along with the latest State Tax Rates. Overview of Florida Taxes.

To get the hotel tax rate a percentage divide the. If a taxable sale is less than a whole dollar amount Florida uses a bracket system for collecting sales tax. If you stay one night you will pay 19 in taxes.

Ie it is in the sidebar for the Orlando page Vegas Page etc. Total taxessurchargesfees hotel bill. The resorttourist tax hasnt changed since 2006.

If your hotel is in Orlando FL which is in Orange County FL your hotel cost will be the price of the room plus 65 sales tax 60 resorttourist tax for a total of 125 BTW that resorttourist tax may also be called an occupancy tax but may also be known as a lodging tax a room tax a sales tax or a hotel tax. NA tax not levied on accommodations. Florida has a 6 statewide sales tax rate but also has 367 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 1037 on top.

If youre moving to Florida from a state that levies an income tax youll get a pleasant surprise when you see your first paycheck. An example of the cost for a week stay at a 300 a night Orlando hotel will be 236250. Numbers represent only state taxes not.

TaxAmount 2 Tax Amount 3 Tax Amount 4. Sales and Gross Receipts Taxes in Florida amounts to 352 billion. The Florida sales tax rate is currently.

Including taxes and surcharges Lodging Calculator For prorating taxes when lodging expenses exceed the allowable amount. Florida Estate Tax. How Do You Calculate Florida Sales Tax.

Than adding 26250 in taxes for the 125 rate in Orange County. Collection of the Tourist Tax. The County sales tax rate is.

The Florida Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Florida State Income Tax Rates and Thresholds in 2022. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. The Sunshine States tax on beer is 48 cents per gallon and the tax on spirits is 650.

7 state sales tax plus 6 state hotel tax 13 if renting a hotel or room. Floridas taxes on alcohol are among the highest in the US. The calculator can be found in the sidebar of each city page.

You are able to use our Florida State Tax Calculator to calculate your total tax costs in the tax year 202122. The total cost of booking rises from 268 to 308 after the fee. This is the total of state county and city sales tax rates.

The Tampa sales tax rate is. Divide the hotel tax per night by the cost of the room before taxes to get the rate. Florida has no state income tax which makes it a popular state for retirees and tax-averse workers.

Details of the personal income tax rates used in the 2022 Florida State Calculator are published below the. You can find the rate by multiplying the answer by 100. TaxesSurchargesFees on hotel receipt.

Lodging is subject to state sales tax and state hotel tax. The sales tax rate was last raised in 2003. Steps 1 to 3 will allow you to calculate Sales Tax on the net or gross sales cost of goods andor services for the area chosen.

7 state sales tax plus 1 state hotel tax 8 if renting a whole house. If youre looking to pass on that beach house in Miami to your heirs you can rest easy. City of Miami Beach 1700 Convention Center Drive Miami Beach Florida 33139 Phone.

As of December 31 2004 theres no estate tax in Florida. This is assuming that the hotel is not charging any. 54 rows 125.

How To Charge Your Customers The Correct Sales Tax Rates

Texas Sales Tax Calculator Reverse Sales Dremployee

Business Owners What Is Your End Game Success Accounting Group Bookkeeping Bookkeeping Services Audit Services

States With Highest And Lowest Sales Tax Rates

1843 Hancock Bridge Parkway Cape Coral Fl 33990 Century 21 Real Estate Waterfront Homes Selling Real Estate

Sales Tax Calculator Apps On Google Play

The 10 Most Gorgeous Swimming Pools In Miami Beach Swimming Pools Miami Hotels Raleigh Hotels

Florida Income Tax Calculator Smartasset

Arizona Sales Tax Small Business Guide Truic

5 Smart Ways To Invest Your Tax Refund Bankrate Tax Refund Finance Investing

Ifta Fuel Tax Software Irs Taxes Tax Debt Irs

Sales Tax Calculator Apps On Google Play

How To Get A Tax Deduction For Charitable Giving Bankrate Com Tax Deductions Bankrate Com Charitable Giving

Florida Income Tax Calculator Smartasset

What Is Fed Oasdi Ee Tax On My Paycheck Tony Florida Business Tax Deductions Tax Deductions Small Business Tax

55 Sea Park Boulevard 209 Florida Real Estate Florida Living House Hunting

Image Result For Chicago North Shore Map North Shore Lake Bluff Chicago

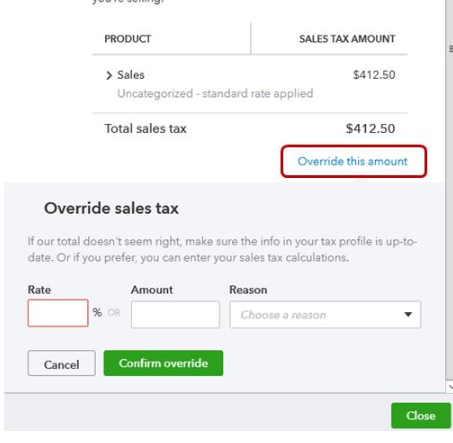

Qb Online Has Changed It Sales Tax Processing It Does Not Work For Me Is Anyone Else Having Problems With New Sales Tax System